Southern Select Corporation Annual Report 2024-25

2024‑25 Annual Report: Southern Select Super Corporation

Section Heading

Annual Report: online version

-

Covering letter

The Hon. Anastasios (Tom) Koutsantonis MP, Treasurer

Dear TreasurerOn behalf of the Board of the Southern Select Super Corporation, I am pleased to present the Annual Report for the Financial Year ended 30 June 2025.

The Report is submitted for your information and presentation to Parliament in accordance with the requirements of Regulation 23 of the Public Corporations (Southern Select Super Corporation) Regulations 2012 and Premier and Cabinet Circular PC013 Annual Reporting.This Report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the Southern Select Super Corporation Board by:

June Roache

Presiding MemberDate

30/09/2025 -

From the Board and Chief Executive

It is our pleasure to present the Southern Select Super Corporation Board Annual Report for 2024-25.

Our Strategic direction

The Board commenced 2024-25 with a new approved Three-Year Strategic Plan after determining our Vision was to be the most trusted superannuation fund for current and former South Australian public servants and our Purpose was to provide superannuation services to ensure members’ financial security and well-being into retirement. Our Vision and Purpose are supported by four pillars: Our People, Members and Employers, Financial Sustainability and Process.

During the year, we have focussed on developing and supporting our people, delivering education and services that provide value to our members, enhancing our financial sustainability with improved funds under management, and seeking continuous improvement and efficiencies for the insurance offering and the digitisation of member access.

Our Performance

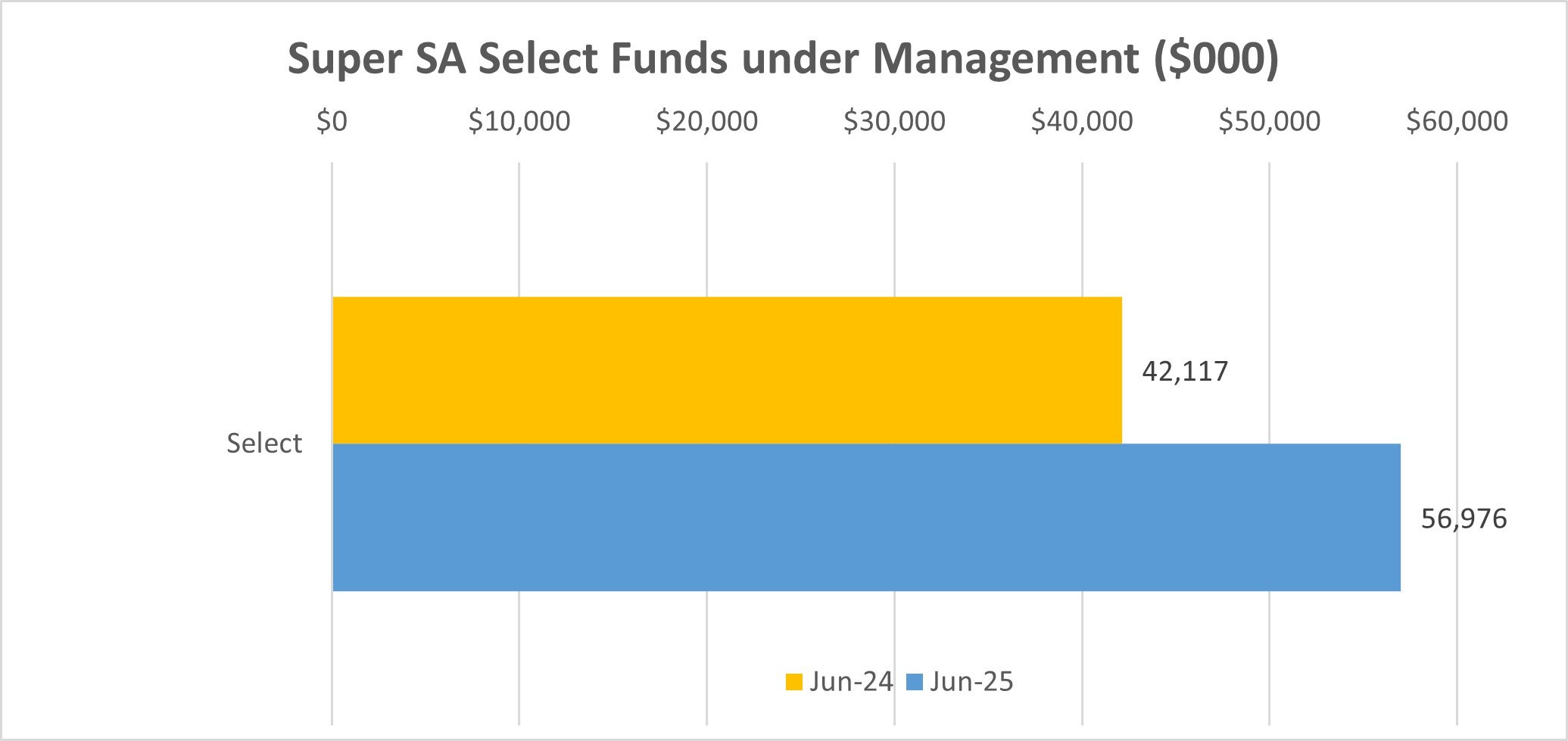

Super SA experienced continued growth in both funds under management and its membership base during the year which highlights the confidence South Australian current and former public public servants have in Super SA to responsibly manage their retirement savings. As at 30 June 2025, Super SA’s funds under management amounted to $56.9 million, with a total membership of 2,995.

Compared with the previous financial year end, these financial sustainability indicators were increases of $14.8 million or 35.3%, and 995 members or 49.8%.

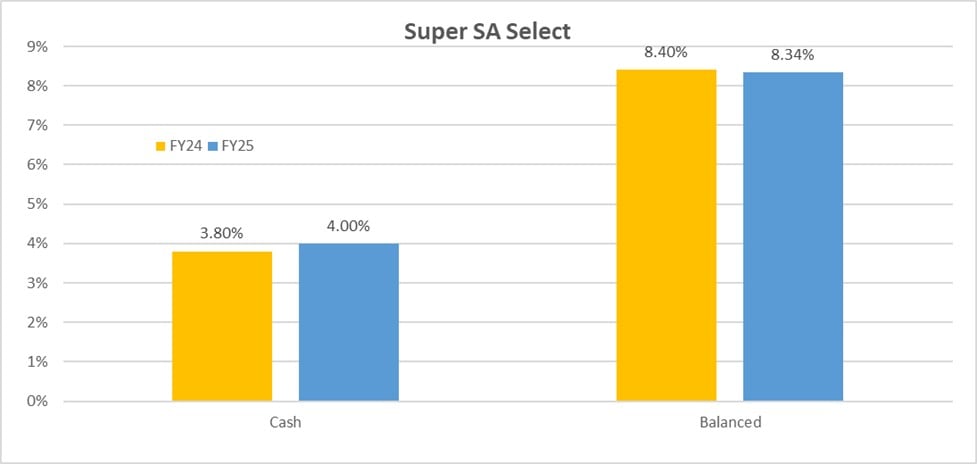

Although 2025 was a challenging year for markets with political and economic events contributing to increased volatility, the Select Balanced option had a positive return of 8.93%.

By statute, Super SA’s funds are managed and controlled by the Superannuation Funds Management Corporation of South Australia (Funds SA). We value our partnership and strong relationship with Funds SA.

The Future

We will continue to engage with our people and ensure Super SA is a workplace of choice.

We will continue to be readily accessible to our members either in person at our city Member Centre, our call centre or on-line to ensure an optimised member experience.

We are developing new products that meet the evolving needs of members as they approach and move through retirement.

We will continue to focus on achieving strong long-term investment performance, supported by deep expertise and a robust investment strategy in collaboration with our investment partner, Funds SA, to ensure strong investment outcomes for members.

Thank You

We extend our gratitude to the Board and all Super SA staff for their continued dedication to members’ best interests during the past 12 months and look forward to continuing success in 2025-26.

We especially acknowledge Richard Dennis AM PSM who completed his term of appointment on 24 July 2025 after initially being appointed to the Board in September 2016.

To all our members, thank you for entrusting us as your superannuation provider. We value your membership and your trust in us.

Signed by:

June Roache, Presiding Member

Southern Select Super Corporation BoardTricia Blight, Chief Executive

Super SA -

Contents

Overview: about the agency

Our strategic focus

Our organisational structure

Changes to the agency

Our Minister

Our Board (as at 30 June 2025)

Legislation administered by the agency

Other related agencies (within the Minister's area/s of responsibility)

Performance at a glance

The agency’s performance

Agency specific objectives and performance

Financial performance at a glance

Financial performance

Risk and audit at a glance

Risk management

Fraud detected in the agency

Strategies implemented to control and prevent fraud

Public interest disclosure

Public complaints

Number of public complaints reported

Additional metrics

Service improvements

Compliance statement

Appendix: Audited financial statements 2024-25 -

Overview: about the agency

Our strategic focus

Our Vision

To be the most trusted superannuation fund for current and former South Australian public servants

Our PurposeTo act as trustee of Super SA Select in accordance with its obligations under the Public Corporations (Southern Select Super Corporation) Regulations 2012 and administer the trust deed and rules of Super SA Select.

Our Values

Super SA Focussed Values:

Service and Dedication – we are members serving members, so we go the extra mile and always look for ways to do better

Professionalism and Insight – our experience means we know our SA members, and we build on this knowledge to deliver the best outcomes

Honesty and Integrity – our ethical principles are non-negotiable, and we act in our members’ best interests transparently and consistently

SA Public Sector – Additional Values:

- Respect

- Collaboration and Engagement

- Trust

- Courage and Tenacity

- Sustainability

Our functions, objectives and deliverables

Our strategy is to excel and improve member experience whilst being competitive on fees and returns.

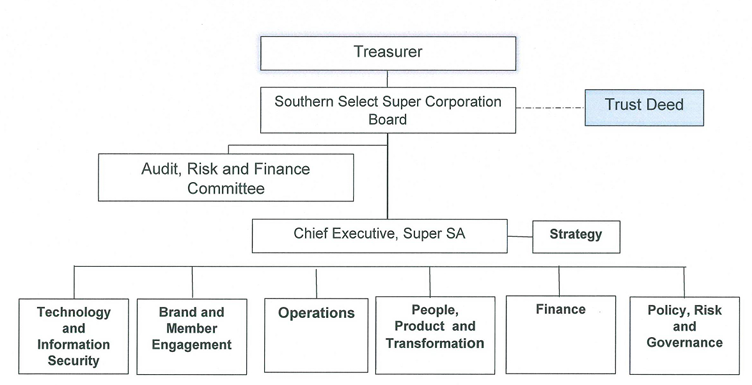

Our organisational structure

During 2024-25 there were no changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes.

Changes to the agency

Our Minister

The Hon. Stephen Mullighan MP was the Treasurer and is the Minister responsible for Superannuation as at 30 June 2025.

Our Board (as at 30 June 2025)

June Roache

Presiding Member (Chair), appointed by the Governor from 27 July 2023 - 1 December 2025.

Ms Roache has extensive business experience, having held chief executive roles and several governance roles in South Australia, nationally and internationally. Her experience extends to commercial, health, sports, arts and regulatory and not-for-profit organisations.

She is also currently Presiding Member of the South Australian Superannuation Board and Chair and Board Director of the South Australian Forestry Corporation.

Ms Roache has a Degree in Accounting from the University of SA, a Graduate Certificate in Management from Mt Eliza Business School and is a Fellow of the Australian Institute of Company Directors, CPA Australia and the Institute of Managers and Leaders.

Alison Kimber

Member representative elected from 2 October 2024 - 1 October 2027.

Significant board and executive experience in financial markets, superannuation, and community service delivery. More than 30 years’ experience in the finance, government, and not-for-profit sectors.

Fellow of the Australian Institute of Company Directors and Fellow of the Institute of Actuaries of Australia.

Councillor, Australian Institute of Company Directors SA Division, Chair, Adelaide Jazz Club Association, Board Member, ACT City Renewal Authority Board and Board member Can Do Group.

William Griggs

Member representative elected from 2 October 2024 - 1 October 2027.

Bill Griggs brings to the Board significant leadership and board experience, with expertise in corporate governance, people and culture, superannuation, investment, and insurance. He has a particular interest in managing/coping during times of uncertainty, and in evidence-based decision making.Current Directorships or equivalent - Director, Funds SA, Director, Return to Work SA, Board Member of the South Australian Superannuation Board and Board member, St John Ambulance.

Fellow of Australian Institute of Company Directors.

Richard Dennis

Appointed by the Governor from 25 July 2024 - 24 July 2025.

Richard Dennis is a legal practitioner and consultant and held the position of South Australian Parliamentary Counsel 2006-2015.

Director of the Order of Saint John of Jerusalem Knights Hospitaller Australasia and Board Member of the South Australian Superannuation Board.

Rosina Hislop

Appointed by the Governor from 14 December 2023 - 13 December 2026.

Rosina is an accomplished board director and a national facilitator with the Australian Institute of Company Directors. She brings international experience in capital finance, mergers and acquisitions and audit and risk.

Rosina’s other directorships are Chair, ECH and independent director at Jones Radiology.

Attendance at Board and Committee meetings

All members serve in a part-time capacity.

Board members attend a variety of national conferences and education seminars.

During the 2024-25 year, Board members attended the Association of Superannuation Funds of Australia Conference.

Name

Board

Audit, Risk and Finance Committee

Eligible to attend

Attended

Eligible to attend

Attended

June Roache

11

11

5

5

Rosina Hislop

11

11

5

5

Richard Dennis

11

10

5

4

Bill Griggs

11

8

5

4

Alison Kimber

11

10

5

4

Legislation administered by the agency

The Board is established and governed pursuant to the Public Corporations (Southern Select Super Corporation) Regulations 2012 and as trustee, is responsible to the Treasurer for all aspects of the administration of the Public Corporations (Southern Select Super Corporation) Regulations 2012. Super SA Select is administered pursuant to a trust deed and rules.

The Southern Select Super Corporation Charter has been prepared in accordance with regulation 15 of the Public Corporations (Southern Select Super Corporation) Regulations 2012.The functions of the Board are described in Regulation 13.

The Government of South Australia, other states and territories and Commonwealth Government have entered into a Heads of Government Agreement on superannuation (HOGA) that recognises certain public sector schemes are exempt public sector superannuation schemes and therefore exempt from the Commonwealth’s Superannuation Industry (Supervision) (SIS) Act 1993 (SIS Act).

Each scheme is, however, deemed to be a complying fund in terms of the SIS Act, for superannuation guarantee purposes under the Superannuation Guarantee (Administration) Act 1992 and for income tax purposes under the Income Tax Assessment Act 1936. In terms of the HOGA, the government has made a commitment to use best endeavours to ensure that the exempt public sector schemes conform to the principles of the Commonwealth's retirement income policy objectives.Other related agencies (within the Minister's area/s of responsibility)

Super SA

On behalf of the Board, Super SA is responsible for administering Super SA Select in accordance with its trust deed and rules.

This arises from the Public Corporations (Southern Select Super Corporation) Regulations 2012, which enables the Board to make use of the staff or facilities of an administrative unit of the SA Public Sector, with the approval of the Minister of that administrative unit. Super SA, a branch of the Department of Treasury and Finance, provides administrative services to the Corporation on this basis.

The Board's service level contract with the Department of Treasury and Finance sets out specific performance standards. The contract was extended to 30 June 2026.

The annual budget for the operation of Super SA Select is presented to the Board for its approval.

The use of consultants, contractors, Work, Health and Safety reporting and executive employment statistics are included in the Department of Treasury and Finance's Annual Report.

Funds SA

In accordance with the Public Corporations (Southern Select Super Corporation) Regulations 2012, the Corporation is responsible for the investment and management of the fund and must prepare an investment policy statement and set the risk/returns objectives and asset allocation policies to be adopted. In fulfilling these obligations, the Corporation consults with the Superannuation Funds Management Corporation of South Australia (Funds SA). Funds SA implements the Corporation's investment policy statement and strategies as agent.

Funds SA prepares an annual Performance Plan, which outlines planned initiatives and proposed strategies.

The current Memorandum of Agreement between Funds SA and Super SA was executed in February 2022. Funds SA provides this service under legislation. The agreement is reviewed on a three yearly basis or when a significant change occurs. -

The agency’s performance

Performance at a glance

Super SA’s performance is assessed continuously against key objectives at least every quarter. This ensures the projects and initiatives conducted throughout the year are aligned to meet the key objectives and performance metrics.

Over the last financial year, Super SA has delivered on a number of initiatives that focus on improving the fund’s operating model and continue to enhance services to members:

- Delivered the Forward Unti Pricing project, which provides a modern and improved method of managing our assets and aligning to industry best practice standard.

- Commenced a review and process improvements within Insurance.

- Reviewed the investment products available to members and begun development of a new suite of products that are competitive with peer funds and provide improved choice and outcomes for members.

Super SA also aligns with the Australian Prudential Regulatory Authority (APRA) standards, where possible. The HOGA requires that Super SA use a best endeavours approach to do so. In striving to achieve this we have undertaken:

- Ongoing delivery of the Protecting Your Super program that addresses account erosion due to excessive fees

- An upgrade of the SuperStream Rollover facility to meet ATO requirements

- Continued development of a cyber security strategy in line with the SA Government’s Cyber Security Framework.

Agency specific objectives and performance

Financial Year Area 2024-25

Actual2024-25

Target2023-24

Actual2023-24

Target2022-23

ActualAchievement of approved service level standards by 30 June each year 87% 85% 86% 84% 73%3 Benchmarking of administrative costs with industry standards*— remain in the most cost efficient quartile of industry standards* while providing additional services to members In the most cost efficient quartile In the most cost efficient quartile In the most cost efficient quartile In the most cost efficient quartile In the most cost efficient quartile Benchmarking of total fees (administration and investment costs) with industry standards and peer funds* In the most cost efficient quartile In the most cost efficient quartile In the most cost efficient quartile In the most cost efficient quartile In the most cost efficient quartile *Based on last available Chant West Super Fund Fee Survey

Super SA’s objectives

Indicators

Result

Our People Staff culture target 70%

76% - Achieved

Member and Employer Achievement of service level standards (All)

Target 85%Achieved - 87%

Complaints management

Target <265 complaints per yearAchieved - 212

Financial Sustainability Within FY25 Budget – OPEX & Project

Achieved

Process Achievement of service level standards – Operations

Target 87%Achieved - 95%

-

Financial performance

Financial performance at a glance

The following is a brief summary of the overall financial position of the agency. Full audited financial statements for 2024-2025 are attached to this report.

The total value of assets under management as 30 June 2025 was $56.9 million, $14.8 million more than the $42.1 million as 30 June 2024.

Funds under management

The comparison of the 2025 and 2024 funds under management by scheme is shown in the graph below.

Investment returns

The comparison of the 2025 and 2024 investment returns for Super SA Select over each investment option is shown in the graph below.

-

Risk management

Risk and audit at a glance

The Super SA Governance and Risk Team’s responsibilities include oversight of risk management, compliance, the Board’s anti-money laundering and counter-terrorism financing program, incident management and business continuity management. The Team also manage Internal Audit reviews conducted by an external provider.

Fraud detected in the agency

No actual or reasonably suspected incidents of fraud were detected during the year.

Strategies implemented to control and prevent fraud

To ensure a strong control environment exists to prevent the occurrence of fraud, Super SA has implemented strong monitoring and validation controls over benefit payments, including verification with members of large benefit payment requests, system-based identification of unusual member account activity, validation of proof of identity prior to payment, and independent review and authorisation of all benefit payments.

Regular information is provided to the Board from internal and external audit, the Audit, Risk and Finance Committee and the Chief Executive.

Super SA maintains the Board’s Risk Management Strategy and Plan; a Business Continuity Framework and Plan; an Internal Audit Plan; a Compliance Framework and an Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Program.

Data for previous years is available at: Super SA Annual Reports.

Public interest disclosure

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018: NIL

Data for previous years is available at: Super SA Annual Reports.

Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1/7/2019.

Public complaintsNumber of public complaints reported

Complaint categories

Sub-categories

Example

Number of Complaints

2024-25

Professional behaviour

Staff attitude

Failure to demonstrate

values such as empathy,

respect, fairness,

courtesy, extra mile;

cultural competency0

Professional behaviour

Staff competency

Failure to action service request; poorly informed decisions; incorrect or incomplete service provided

0

Professional behaviour

Staff knowledge

Lack of service specific knowledge; incomplete or out-of-date knowledge

0

Communication

Communication quality

Inadequate, delayed or absent communication with customer

1

Communication

Confidentiality

Customer’s confidentiality or privacy not respected; information shared incorrectly

0

Service delivery

Systems/technology

System offline; inaccessible to customer; incorrect result/information provided;

poor system design

0

Service delivery

Access to services

Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities

0

Service delivery

Process

Processing error; incorrect process used; delay in processing application; process not customer responsive

1

Policy

Policy application

Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given

0

Policy

Policy content

Policy content difficult to understand; policy unreasonable or disadvantages customer

0

Service quality

Information

Incorrect, incomplete, out dated or inadequate information; not fit for purpose

0

Service quality

Access to information

Information difficult to understand, hard to find or difficult to use; not plain English

0

Service quality

Timeliness

Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met

0

Service quality

Safety

Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness

0

Service quality

Service responsiveness

Service design doesn’t meet customer needs; poor service fit with customer expectations

0

No case to answer

No case to answer

Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate

0

Total

2

Additional metrics Total Number of positive feedback comments 0 Number of negative feedback comments 0 Total number of feedback comments 0 % complaints resolved within policy timeframes 100%

within 45 days

(responses to

complaints received in

the 2024-2025

financial year)

Data for previous years is available at: Super SA Annual Reports

• Forward Unit Pricing was implemented, which changed how unit prices are applied to member accounts, moving to a method based on market value at the end of the transaction day. This allows member transactions to be made with the most up to date asset values and better aligns with industry best practice.

Service improvements

• Expanded the delegations to facilitate faster and more efficient approval of particular low risk member requests.

• Introduced a Child Safety policy to safeguard our child members and delivered staff training to ensure its effective implementation.

Compliance statementSuper SA Select is compliant with Premier and Cabinet Circular 039 – complaint management in the South Australian public sector Y

Super SA Select has communicated the content of PC 039 and the agency’s related complaints policies and procedures to employees. Y

-

Appendix: Audited financial statements 2024-25