South Australian Superannuation Board Annual Report

2021‑22 Annual Report: South Australian Superannuation Board

Section Heading

Annual Report: online version

-

Covering letter

To: Hon. Stephen Mullighan MP, Treasurer

This annual report will be presented to Parliament to meet the statutory reporting requirements of section 21 and schedule 3 (section 10) of the Superannuation Act 1988 and section 16 of the Southern State Superannuation Act 2009 and the requirements of Premier and Cabinet Circular PC013 Annual Reporting.

This report is verified to be accurate for the purposes of annual reporting to the Parliament of South Australia.

Submitted on behalf of the South Australian Superannuation Board by:

Virginia Deegan, Board Member, South Australian Superannuation Board

-

From the Board and Chief ExecutiveIt is our pleasure to present our 2021-22 Super SA Annual Report.

Delivering best member outcomes

Our members are always at the heart of everything we do at Super SA. Through member surveys and feedback, we continue to learn more about what our members want. This helps us stay focussed on delivering services aligned to best member outcomes.

Throughout this year, we’re pleased to have delivered the following initiatives for members:

- Launched an award-winning website that is responsive, more secure and easier to navigate, with access to a range of resources. This includes new calculators, like the Risk Profiler and Super Projection

- Upgraded the member portal to improve navigation. We also added an extra layer of security with two-factor authentication supporting the Fund’s strong focus on cyber and information security

- Removed the investment switching fee on 1 April 2022, meaning investment options can be changed at no cost to members

- Refurbished the Member Centre at 151 Pirie Street, Adelaide giving members who visit us the best possible experience.

We are proud to have been awarded an ESG Leader Rating for 2022. This recognises our strong commitment to implementing environmental, social and governance (ESG) principles, while having a track record of strong investment performance.

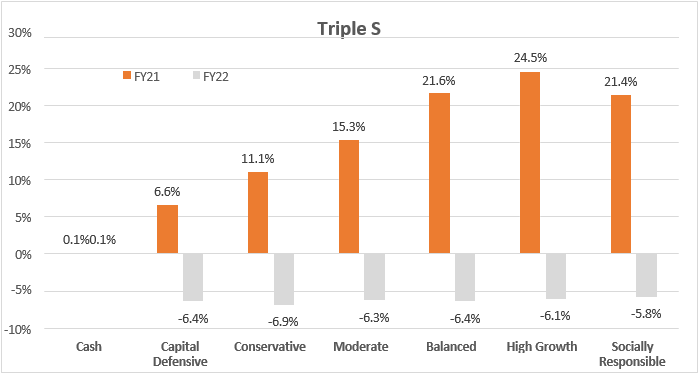

Investment Performance

The Financial market environment has been volatile and returns were mostly negative over the year. Investment performance was impacted by:

- the combination of high inflation; tighter monetary policy and aggressive central bank actions; rising risks to economic growth and the possibility of recession; the ongoing Russia-Ukraine conflict; and COVID-19 related lockdowns in China have proven challenging for financial markets

- defensive asset classes such as Fixed Interest produced negative returns as interest rates and credit spreads rose sharply

- global and domestic Equities also produced negative returns as valuations fell in response to interest rate movements. Company earnings have held up to date, however the outlook is uncertain

- unlisted assets such as Property and Diversified Strategies Growth provided positive returns, benefiting from the lagging nature of valuations which have not yet been impacted by rising interest rates.

It's important to remember superannuation is a long-term investment and our investment strategies continue to focus on long-term performance, especially during periods of extreme volatility.

Better super for all AustraliansThe Fund implemented the increase to the Superannuation Guarantee (SG) from 10 per cent to 10.5 per cent from 1 July 2022.

Looking aheadFrom 30 November 2022, Fund Selection and Limited Public Offer will be available at Super SA. This will mean that all eligible South Australian public sector employees will have the option to choose where they direct their super contributions.

For 119 years, Super SA has helped South Australian public sector employees plan for their future.

As we enter a competitive environment Super SA will strive to retain its loyal membership. We will do this by continuing to measure our service and develop ways of enhancing service delivery to members.

Thank you

To all our members, we thank you for your continued support.

I also thank the Board and all Super SA staff for their support to deliver good member outcomes throughout the past 12 months.Signed by:

Virginia Deegan, Board Member

Southern Select Super Corporation

Dascia Bennett, Chief Executive

Super SA -

Contents

Overview: about the agency

Our strategic focus

Our organisational structure

South Australian Superannuation Board

Board and its Committees

- Board Members as at 30 June 2022

- Changes to the agency

Our Executive team

Legislation administered by the agency

Other related agencies (within the Minister's area/s of responsibility)

Performance at a glance

The agency’s performance

Agency response to COVID-19

Agency contribution to whole of Government objectives

Agency specific objectives and performance

Corporate performance summary

Financial performance at a glance

Financial performance

Other financial information

Risk and audit at a glance

Risk management

Fraud detected in the agency

Strategies implemented to control and prevent fraud

Public complaints

Number of public complaints reported

Additional metrics

Service improvements

Compliance statement

Appendix: Audited financial statements 2021-21

-

Overview: about the agency

Our strategic focus

Our Purpose

Our purpose is to champion the financial well-being of our members.

The Board is responsible for the administration of:

- Triple S Scheme

- Pension Scheme

- Lump Sum Scheme

- Income Stream

- Flexible Rollover Product

- SA Ambulance Service Superannuation Scheme.

Our VisionTo be the most respected superannuation fund.

Our ValuesDedication – we are members serving members, so we go the extra mile and always look for ways to do better

Insight – our experience means we know our SA members, and we build on this knowledge to deliver the best outcomes

Integrity – our ethical principles are non-negotiable, and we act in our members’ best interests transparently and consistently.

Our functions, objectives and deliverablesOur strategy is to excel and improve member experience whilst being competitive on fees and returns.

We have three high-level strategic objectives which are supported by strategic themes to ensure Super SA will continue to be a viable and dynamic superannuation fund for South Australia.

High level strategic objectives:- Grow the Fund under Management to $43.1 billion by 30 June 2024*

- Net investment returns comparative to Super SA six key competitors

- Fees – in the most cost-efficient quartile of funds while delivering additional services to members

Four strategic themes:- Member and Employer Engagement – to enhance the member experience to drive engagement, activation and retention

- Future Proofing – Transform the Fund for long-term sustainability

- Competitive Products – to design product / investment options that deliver to member expectations in a competitive environment

- Member Centric Culture – to engage employees to deliver an efficient and member centric service.

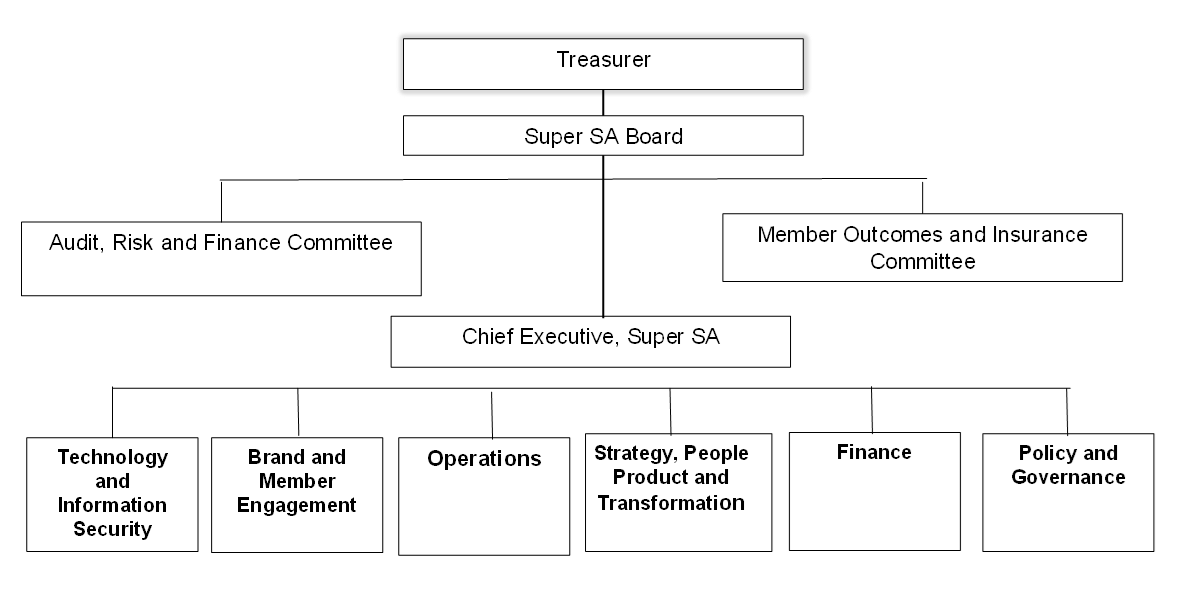

Our organisational structure

South Australian Superannuation BoardBoard and its Committees

The South Australian Superannuation Board (known as the Super SA Board) is responsible for:

- ensuring compliance with Super SA’s enabling legislation

- approving the Strategic Direction of Super SA

- reviewing reporting against the achievement of the Strategic plan

- reviewing the long-term resourcing and scheme sustainability

- approving enhanced products

- approving delegations of decision-making powers (including any limits on these delegations) are in place and clearly documented

- determining Board policy

- determining member appeals

- approving and monitoring the implementation of budgets and plans for all major projects.

Board Members as at 30 June 2022

The Super SA Board has five Board members. They are:

Mr Gregory Boulton AMPresiding Member (Chairman), Super SA Board

Appointed by the Governor until 8 September 2022.

Significant Superannuation and Investment experience as a Trustee Director of Statewide Super for 11 years. Thirty years’ experience as Managing Director, Director and Chairman of Public and Private Companies. Fellow of Australian Institute of Company Directors and Institute of Chartered Accountants.

Chairman of Southern Gold Limited, Director, SA Pine Pty Ltd and Presiding Member, Southern Select Super Corporation.

Ms Virginia DeeganAppointed by the Governor until 22 July 2023.

Executive Director Infrastructure, University of Adelaide.

Extensive board and executive management experience across a range of sectors including superannuation, health, and higher education.

A Fellow of CPA Australia (FCPA) and Member of Australian Institute of Company Directors.

Board Member of the Southern Select Super Corporation, Member, SA Health Risk Management and Audit Committee and Director, Stawell Underground Physics Lab Pty Ltd.

Ms Alison KimberMember elected representative until 1 October 2024.

Significant board and executive experience in financial markets, superannuation, and community service delivery. More than 30 years’ experience in the finance, government, and not-for-profit sectors.

Fellow of the Australian Institute of Company Directors and Fellow of the Institute of Actuaries of Australia.

Chair, Uniting Care Wesley Bowden; and Councillor, Australian Institute of Company Directors SA/NT and Board Member, Southern Select Super Corporation, Member, Cabaret Fringe Association Board, Member, ACT City Renewal Authority Board and Board member Can Do Group.

Associate Professor William Griggs AM ASMMember elected representative until 1 October 2024.

Bill Griggs brings to the Board significant leadership and board experience, with expertise in corporate governance, people and culture, superannuation, investment, and insurance. He has a particular interest in managing/coping during times of uncertainty, and in evidence-based decision making.

Current Directorships or equivalent: Director, Funds SA, Director, Return to Work SA; and Board Member, Southern Select Super Corporation, and Board member, St John Ambulance. Fellow of Australian Institute of Company Directors.

Mr Richard Dennis AM PSMAppointed by the Governor until 22 July 2024.

Legal practitioner and consultant; South Australian Parliamentary Counsel 2006-2015

Governor of the Wyatt Trust, Member, Anglican Diocese of Adelaide Legal Committee and Board member, Southern Select Super Corporation.All members serve in a part-time capacity.

Board members can attend a variety of national conferences and education seminars. During 2021-22 Board members attended the Association of Superannuation Funds of Australia Conference and Australian Institute of Company Directors – Board’s Role in Setting Culture, Governance Summit and Digital Transformation and the Board.

The Presiding Member attended the Centre for Institutional Investors Chairs and Chief Executives Conference.

Unfortunately, the impact of COVID resulted in some planned conferences being delayed or cancelled.

Attendance at Board and Committee meetingsName

Board

Audit, Risk and Finance Committee

Member Outcomes and Insurance Committee

Eligible to attend

Attended

Eligible to attend

Attended

Eligible to attend

Attended

Greg Boulton

13

12

5

5

2

2

Virginia Deegan

13

13

5

5

Richard Dennis

13

13

5

5

Bill Griggs

13

11

2

2

Alison Kimber

13

13

2

1

John Wright

2

2

Changes to the agencyDuring 2021-22 there were no changes to the agency’s structure and objectives as a result of internal reviews or machinery of government changes.

Our MinisterThe Hon. Stephen Mullighan MP is the Treasurer and is the Minister responsible for Superannuation.

Our Executive team

Dascia Bennett, Chief Executive

Responsible for leading the organisation and delivering on the Corporation’s strategic agenda whilst ensuring that Super SA meets it legislative and reporting requirements for all superannuation funds managed.

Adrian De Silva, Director, Strategy, People, Product and Transformation

Responsible for providing leadership, management, product and strategic advice across Super SA. This includes accountability for the design and alignment of legacy and new superannuation product offerings to meet member outcomes, as well as providing contemporary human resources and organisational development practices enabling business solutions and oversight of major transformational projects.

Mike Gulliver, Director, Technology and Information Security

Responsible for providing strategic and operational leadership to deliver technology and data services in support of Super SA’s strategy and ongoing benefit for members. This includes responsibility for technology roadmap development, Information Communication Technology (ICT) service delivery model, and cyber security practices aligned to government requirements and APRA Prudential Standards. This role is also accountable for managing contractual ICT service level agreements, budgets, and key relationships with agencies, regulators, and external technology partners.

Lorna Harrison, Director, Operations

Responsible for leading the Operations team to ensure the timely and accurate collection of contributions and member data, payment of benefits, administration of post retirement services and the annual review process for the Funds administered by Super SA. In addition, the role leads the insurance delivery service.

Mark Hordacre, Director, Finance

Responsible for leading the Finance, Actuarial and Procurement group in the design and delivery of sound financial management services for the benefit of our members and relevant agencies. This includes responsibility for the provision of financial and management accounting services to the Schemes and the Board, tax and investment operations for the Schemes, and oversight of the Funds SA operational relationship.

Patrick McAvaney, Director, Policy and Governance

Responsible for the provision of leadership and advice in the areas of legislation, policy, dispute resolution, risk management, compliance and governance practices across Super SA, including its Boards and Committees.

Karen Raffen, Director, Brand and Member Engagement

Responsible for leading the design and implementation of a contemporary Brand, Marketing and Member Experience strategy for the Fund. She is responsible for the areas of member services, financial planning, marketing and member experience. The role also develops business solutions that optimise the Super SA Board’s strategic objectives in relation to maintaining and improving scale through membership retention and growth and enabling member to live their best possible life.

The Super SA Board is responsible to the Treasurer for all aspects of the administration of:

Legislation administered by the agency

- Southern State Superannuation Act 2009 (Triple S, Flexible Rollover Product and Income Stream); and

- Superannuation Act (Lump Sum and Pension Schemes), except for the management and investment of the funds.

The Board also acts as trustee of the SA Ambulance Service Superannuation Fund and is responsible for administering the Trust Deed and rules.

The Government of South Australia, other state and territory governments and Commonwealth Government have entered into a Heads of Government Agreement that recognises certain public sector schemes are exempt public sector superannuation schemes (and therefore exempt from the Commonwealth’s Superannuation Industry (Supervision) Act 1993 (SIS Act). Each scheme is, however, deemed to be a complying fund in terms of the SIS Act, for superannuation guarantee purposes under the Superannuation Guarantee (Administration) Act 1992 and for income tax purposes under the Income Tax Assessment Act 1936. In terms of the agreement, the state government has made a commitment to use best endeavours to ensure that the exempt public sector schemes conform to the principles of the Commonwealth’s retirement income policy objectives.

Other related agencies (within the Minister's area/s of responsibility)

Super SA

On behalf of the Super SA Board, the State Superannuation Office (Super SA) is responsible for managing SA Public Sector superannuation schemes in line with relevant acts and legislation.

This arises from section 10(3) of the Superannuation Act 1988, which enables the Board to make use of the staff or facilities of an administrative unit of the SA Public Sector, with the approval of the Minister of that administrative unit. Super SA, a branch of the Department of Treasury and Finance, provides administrative services to the Board.

The annual budget for the operation of Super SA is presented to the Board for its approval.

The Board's service level contract with the Under Treasurer sets out specific performance standards. The contract expires on 30 June 2023.

The use of consultants, contractors, WHS reporting and executive employment statistics are included in the Department of Treasury and Finance's Annual Report.

Funds SAFunds are managed by a specialist investment manager, Superannuation Funds Management Corporation of South Australia (Funds SA). Funds SA manages the investments for each scheme in accordance with sections 17 and 19 of the Superannuation Act 1988, sections 10 and 11 of the Southern State Superannuation Act 2009, and the provisions of the Superannuation Funds Management Corporation of South Australian Act 1995.

The current Memorandum of Agreement between Funds SA and Super SA was executed in February 2022. Funds SA provides this service under legislation. The agreement is reviewed on a three yearly basis or when a significant change occurs.

-

The agency’s performance

Performance at a glance

Super SA performance is assessed continuously against the agency's key objectives every quarter. This will ensure the projects and initiatives conducted through the year are aligned to meet the key objectives.

In delivering our member-centric approach we have:- commenced the roll out of upgraded website calculators

- developed a web-chat functionality for members

- removed the investment switching fee on all schemes and products, allowing members to make multiple investment switches, without being charged.

- redesigned the website which has been award winning and is more secure and easier for our members to navigate

- recruited Business Relationship Managers as employer touch points as we move to Fund Selection in 2022-23.

- commenced the development of a Superannuation Prudential Standard (SPS) 515 framework for Strategic Planning and Best Member outcomes, and implemented changes to budgeting, business planning and business case preparation

- delivered important system changes to support:

insurance

- commenced development of a cyber security strategy in line with Australian Prudential Regulation Authority CPS 234 Information Security and CPS 231 Material Outsourcing. The Super SA Board and Management is particularly focused on cyber security

- implemented two-factor authentication for members to access the portal to protect our members’ data.

- - SuperStream Rollover upgrade to meet ATO requirements

Further information is provided under Agency Objectives.

Agency response to COVID-19In response to COVID-19 Super SA needed to ensure ongoing services to its members. To ensure staff were able to work remotely when required, new workflow processes were implemented. In response to COVID-19 and member demand Super SA is running regular online education webinars, as well as face to face seminars, which are targeted to specific member needs.

Agency contribution to whole of Government objectives

Key objective

Agency’s contribution

Lower costs

- Net investment returns comparative to Super SA’s key competitors

- Fees – in the most cost-efficient quartile of funds

Better Services

Planning for implementation of Fund Selection and Limited Public Offer providing members with choice

Agency specific objectives and performance

2021-22

Actual2021-22

Target2020-21

Actual2020-21

Target2019-20

ActualAchievement of approved service level standards by 30 June each year.

681

90%

85%

90%

89%

Benchmarking of administrative costs with industry standards — remain in the most cost- efficient quartile of industry standards* while providing additional services to members.

In the most cost- efficient quartile

In the most cost- efficient quartile

In the most cost- efficient quartile

In the most cost- efficient quartile

In the most cost- efficient quartile

*Based on last available Chant West Super Fund Fee Survey (March 2022)

1 Service level standards were impacted across the organisation due to additional security measures applied due to the December 2021 SA Government Frontier data breachAgency objectives

Indicators

Performance

Member and Employer Engagement – to enhance the member experience to drive engagement, activation and retention

Achievement of Service Level Standards

Target 90%

Achieved 68%

Service level standards were impacted across the organisation due to additional security measures applied due to the December 2021 SA Government Frontier data breach

Complaints Management

Target: Less than 150 complaints per year

189 complaints were

received during 2021-22.

Education registrations

Target 20,000 membersExceeded target with 20,998 members participating in seminars.

Competitive Products - To design product/investments options that deliver to member expectations in a competitive environment

Achieve cost savings through the enhancement of our superannuation registry platform via the transition to a standardised industry platform.

Moved our major superannuation registry system platform onto a modern consolidated code base to enable:

- future cost savings via a modern digital payment system when SuperStream is implemented

- improved information security through introduction of two factor authentication.

Implement a new general ledger platform for the schemes under management and establish an enterprise data warehouse to improve reporting capabilities and efficiencies.

The new general ledger platform was implemented in October 2021, delivering a new modern, stable system that is compliant and provides security assurance.

To leverage the new general ledger a new data warehouse was delivered with an enhanced cloud- based data lake being implemented in 2022-23 to provide deep analysis of a member’s journey and service needs.Future Proofing - Transform the Fund for long-term sustainability

Introduce Fund Selection and a Limited Public Offer facility for members of the Triple S scheme

Legislative change effective 30 November 2022 will enable eligible members to choose a complying superannuation fund for their government employer contribution.

Future Proofing - Transform the Fund for long-term sustainability

Review the target operating model and registry system.

The Fund’s target operating model includes a review of cost to serve members. A rationalisation of the registry platforms will be undertaken which will streamline the technology infrastructure.

Future Proofing - Transform the Fund for long-term sustainability

Review Reserving policy within the superannuation schemes to replenish reserves and build capacity to undertake future strategic initiatives.

Introduction of an industry good practice Reserving Policy to ensure Fund sustainability. This approach will ensure that future strategic initiatives can be funded to support the modernisation of the Fund.

Future Proofing - Transform the Fund for long-term sustainability

Conduct the three yearly review of insurance premium settings

This was undertaken in 2021 and a new premium setting will be introduced in 2023.

Member Centric Culture – To engage employees to deliver an efficient and member centric service

Staff Culture

Target 70%This objective was exceeded with 76% achieved as at

30 June 2022.

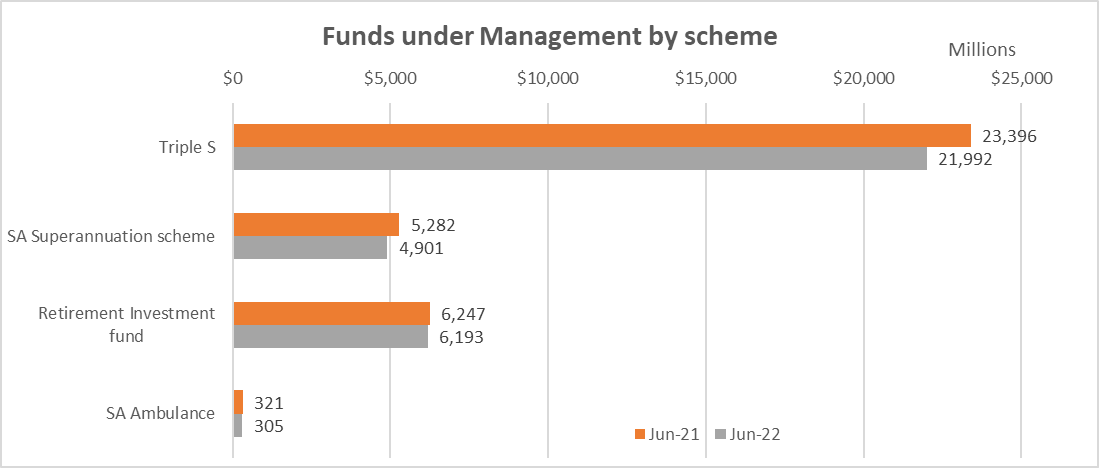

Corporate performance summary

In measuring fund sustainability, Super SA monitors the funds under management by scheme.

Funds under management

The comparison of the 2022 and 2021 funds under management by scheme is shown in the graph below.

Investment returns for Triple SThe comparison of the 2022 and 2021 investment returns for Triple S over each investment option is shown in the graph below:

-

Financial performance

Financial performance at a glance

The funds under management is $33.2 billion as at 30 June 2022.

The total number of members at 30 June 2022 was 210,130 and is consistent with the prior year membership. This figure comprises the following categories of members:

- Triple S active and preserved

- Pension Scheme superannuant, active and preserved

- Lump Sum Scheme active and preserved

- SA Ambulance Service Superannuation Scheme active and preserved

- Super SA Income Stream active, and

- Flexible Rollover Product active.

No. of contributors/ members in state schemes:

2021-22

Forecast2021-22

Actual2022-23

ForecastMembers

191,657

210,130

209,439

- Triple S (total)

156,599

173,021

173,021

o Non-contributors

73,747

98,273

98,156

o Salary Sacrifice contributors only

17,713

18,706

20,182

o After Tax contributors only

9,134

8,780

7,838

o Both After Tax and Salary Sacrifice

4,044

3,551

3,134

o Preserved > $6000 account balance

31,206

32,444

32,444

o Preserved < $6000 account balance¹

20,755

11,267

11,267

- Flexible Rollover Product

7,198

7,572

8,362

- Income Stream

11,116

12,811

12,063

- Superannuants

13,659

13,629

13,282

- Other retirement schemes (Pension, Lump Sum, SA Ambulance)2

3,085

3,097

2,711

o Pension

259

269

203

o Lump Sum

2,216

2,218

1,928

o SA Ambulance

610

610

580

1 The Super SA Board have agreed to opt into the Commonwealth's Inactive Low Balance Account regime for Triple S.

2 Comprises both active and preserved members.The overall preserved membership decreased by 8,339 members to 44,721 members. While all schemes except SA Ambulance experienced a decrease in preserved membership, Triple S experienced a large decrease due to the transfer of low account balances to the Australian Taxation Office, in line with the Protecting Your Super requirements for regulated funds.

Below is a summary of the number of preserved members as at 30 June 2022 (preserved membership numbers as at 30 June 2021 is shown for comparison):No. of preserved members in state schemes:

30 June 2022

30 June 2021

change

Members

44,721

53,060

(8,339)

Triple S (total)

43,711

51,961

(8,250)

Pension

143

176

(33)

Lump Sum

786

846

(60)

SA Ambulance

81

77

4

Other financial informationThe State Government has a strategy to fund both its accruing and accrued past service superannuation liabilities by 30 June 2034.

South Australian Superannuation Fund

Geoff Keen, an actuary with Brett & Watson Pty Consulting Actuaries, performed the actuarial review of the South Australian Superannuation Fund (Pension and Lump Sum Schemes) as at 30 June 2019, and the results are contained in a report dated 11 June 2020.

The review was performed to meet the requirements of Section 21 of the Superannuation Act 1988, which stipulate actuarial reviews be undertaken every three years. This Section of the Act requires the Actuary to provide a report on the following aspects:

- the cost of the scheme to the State Government at the time of the report and in the foreseeable future; and

- the proportion of future benefits under Part 5 of the Act that can be met from the Fund.

Triple S Insurance PoolA triennial review of the Triple S Insurance Pool as at 30 June 2019 was performed by Ms Catherine Nance, an actuary with PricewaterhouseCoopers (PwC).

The next actuarial review of the Triple S Insurance Pool is due to be performed as at 30 June 2022.

SA Ambulance Service Superannuation Scheme

Esther Conway, an actuary acting on behalf of Mercer Consulting (Australia) Pty Ltd performed the actuarial review as at 30 June 2020 to meet the requirements of the scheme’s governing rules, which stipulate that actuarial reviews are to be undertaken every three years.Esther Conway, an actuary acting on behalf of Mercer Consulting (Australia) Pty Ltd performed the actuarial review as at 30 June 2020 to meet the requirements of the scheme’s governing rules, which stipulate that actuarial reviews are to be undertaken every three years.

The next actuarial review of the SA Ambulance Superannuation Scheme is due to be performed as at 30 June 2023.

Full audited financial statements for 2021-2022 are attached to this report.

The next actuarial review of the South Australian Superannuation Fund (Pension and Lump Sum Schemes) will be performed as at 30 June 2022.

Other reporting

Act of Regulation

Requirement

Section 29(1) - Southern State Superannuation Act 2009

The Board may give such directions as are reasonably necessary to resolve a doubt or difficulty that arises under the Act/regulations or circumstances that has arisen that are not addressed under the Act/regulations and any such direction will have effect according to its terms. If the Board gives such a direction, the Board’s report to the Minister in the financial year in which the action is taken must include details of the action.

Details to be reported: Nil

Act of Regulation

Requirement

Section 29(2)(a) -

Southern State Superannuation Act 2009*

If, in the opinion of the Board, a time limit under this Act or the regulations should be extended in particular circumstances, the Board may extend the time limit (even if it has already expired). If the Board extends a time limit, the Board’s report to the Minister in the financial year in which the action is taken must include details of the action.

Details to be reported: 62 (with further details of applicable extended time limits set out below):Reg

36AA(1)The time limit by which a member must apply for income protection benefits

(within 6 months of first absence from

work, or within 6 months of ceasing

workers compensation/leave)31

Reg

48(8) & (9)The time limit by which a Triple S member/spouse member is required to

invest in the Flexible Rollover Product

and continue death and TPD insurance

(60 days)31

Act of Regulation

Requirement

Section 29(2)(b)

Southern State Superannuation Act 2009If, in the opinion of the Board, a procedural step under this Act or the regulations should be waived in particular circumstances, the Board may waive compliance with the procedural step. If the Board waives a procedural step, the Board’s report to the Minister in the financial year in which the action is taken must include details of the action.

Details to be reported: Nil

Act of Regulation

Requirement

Section 20A(5) -Superannuation Act 1988

In determining the rate of return for member accounts, if the Board determines a rate of return that is at variance with the net rate of return achieved by investment of the relevant division of the Fund, the Board must include its reasons for the determination in its report for the relevant financial year.

Reasons for determination: Nil

Act of Regulation

Requirement

Section 25(2)- Superannuation Act 1988

If the Minister attributes additional contribution points/months to a contributor, the Minister must provide the Board with details of the attribution of contribution points or months and the Board must include those details in the report to the Minister.

Details to be reported: Nil

Act of Regulation

Requirement

Schedule 3, section 10 Superannuation Act 1988

Super SA must, in conjunction with each annual report of the Board under this Act, provide a report on the operation of this Schedule in relation to any administered scheme that is within the ambit of a declaration under clause 2(1)(b) during the financial year to which the annual report relates.

The report must include—

(a) a copy of any accounts or financial statements that are required to be audited under this Schedule in respect of each relevant scheme for the financial year; and

(b) if a fund has been managed under Part 3 Division 1 in respect of any part of the relevant financial year— a copy of the audited accounts and financial statements for that fund provided by the Superannuation Funds Management Corporation of South Australia.

Details to be reported: The report on the operation of the SA Ambulance Service Superannuation Scheme and requisite financial statements is included within this annual report.

-

Risk management

Risk and audit at a glance

The Super SA Governance and Risk Team’s responsibilities include oversight of risk management, compliance, the Board’s anti-money laundering and counter-terrorism financing program, incident management and business continuity management. The Team also manage Internal Audit reviews conducted by an external provider.

Fraud detected in the agency

Category/nature of fraud

Number of instances

Financial Impact to Super SA ($)

Fraudulent transactions attempted by external parties on member accounts

3

$Nil

NB: Fraud reported includes actual and reasonably suspected incidents of fraud.

Strategies implemented to control and prevent fraud

To ensure a strong control environment exists to prevent the occurrence of fraud, the Super SA Office has implemented strong monitoring and validation controls over benefit payments, including verification with members of large benefit payment requests, system-based identification of unusual member account activity, validation of proof of identity prior to payment, and independent review and authorisation of all benefit payments.

Regular information is provided to the Super SA Board from internal and external audit, the Audit, Risk and Finance Committee and the Chief Executive.

The Super SA Office maintains the Board’s Risk Management Strategy and Plan; a Business Continuity Framework and Plan; an Internal Audit Plan; a Compliance Framework and an Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Program.

Data for previous years is available here.

Public interest disclosure

Number of occasions on which public interest information has been disclosed to a responsible officer of the agency under the Public Interest Disclosure Act 2018: Nil

Data for previous years is available here.Note: Disclosure of public interest information was previously reported under the Whistleblowers Protection Act 1993 and repealed by the Public Interest Disclosure Act 2018 on 1 July 2019.

Public complaints

Number of public complaints reported

Complaint categories

Sub-categories

Example

Number of Complaints

2021-22Professional behaviour

Staff attitude

Failure to demonstrate values such as empathy, respect, fairness, courtesy, extra mile; cultural competency

2

Professional behaviour

Staff competency

Failure to action service request; poorly informed decisions; incorrect or incomplete service provided

0

Professional behaviour

Staff knowledge

Lack of service specific knowledge; incomplete or out-of-date knowledge

0

Communication

Communication quality

Inadequate, delayed or absent communication with customer

27

Communication

Confidentiality

Customer’s confidentiality or privacy not respected; information shared incorrectly

2

Service delivery

Systems/technology

System offline; inaccessible to customer; incorrect result/information provided; poor system design

13

Service delivery

Access to services

Service difficult to find; location poor; facilities/ environment poor standard; not accessible to customers with disabilities

2

Service delivery

Process

Processing error; incorrect process used; delay in processing application; process not customer responsive

89

Policy

Policy application

Incorrect policy interpretation; incorrect policy applied; conflicting policy advice given

10

Policy

Policy content

Policy content difficult to understand; policy unreasonable or disadvantages customer

33

Service quality

Information

Incorrect, incomplete, outdated or inadequate information; not fit for purpose

0

Service quality

Access to information

Information difficult to understand, hard to find or difficult to use; not plain English

0

Service quality

Timeliness

Lack of staff punctuality; excessive waiting times (outside of service standard); timelines not met

0

Service quality

Safety

Maintenance; personal or family safety; duty of care not shown; poor security service/ premises; poor cleanliness

0

Service quality

Service responsiveness

Service design doesn’t meet customer needs; poor service fit with customer expectations

0

No case to answer

No case to answer

Third party; customer misunderstanding; redirected to another agency; insufficient information to investigate

5

Investments

Investments

Investment fees; Dissatisfaction with investment of assets

6

Total

189

Data for previous years is available here.Additional metrics

Total

Number of positive feedback comments

32

Number of negative feedback comments

170

Total number of feedback comments

202

% Complaints resolved within policy timeframes

76%

Service improvements- Amended the legislation effective 1 April 2022, to permit extensions of the two-year time limit to lodge Total and Permanent Disability claims (TPD) claims, which previously could not be extended under any circumstances.

- Amended the legislation effective 1 April 2022 to improve the Total and Permanent Disablement (TPD) definition in the Flexible Rollover Product (FRP) in respect of the work test (meaning it is less restrictive).

- Removed the investment switching fee on all schemes and products, allowing members to make multiple investment switches, without being charged.

- Introduced an industry best-practice complaints process better aligned to the Australian Securities and Investment Commission Dispute Resolution Regulatory Guide 271, including the acceptance of verbal complaints from 1 July 2022.

- Introduced Protecting Your Super legislation and implemented a process for transferring super balances to the ATO for ‘lost members’ in-line with Protecting Your Super legislation, and to ensure account balances are not eroded by fees.

- Reviewed and updated Board delegations, to allow more staff to process certain payment types, thereby reducing the time taken to action requests and improving services to members.

- Introduced two factor authentication as an extra security measure for members when accessing the online Member Portal.

- Enterprise Release Upgrade: Modern Registry Platform which provides great member information security – digital payment system and fast processing times for members.

- Introduced extra security questions and identification requirements because of the government wide data breach to protect members’ information.

- Implemented a new process for loading Guardianship orders from the Public Trustee to improve member records.

- Updated the Super SA website, including the online Member Portal, and online calculators.

- Review of member communication and consolidation of forms to improve member outcomes.

- Refurbished the Super SA Member Centre, and introduction of a new member face-to-face experience.

Compliance statementSuper SA is compliant with Premier and Cabinet Circular 039 – complaint management in the South Australian public sector

Y

Super SA has communicated the content of PC 039 and the agency’s related complaints policies and procedures to employees.

Y

-

Appendix: Audited financial statements 2021-22