What’s your strategy? Let’s talk diversification

27 October 2025Section Heading

When it comes to superannuation, how your money is invested can make a big difference to your future. But with terms like ‘diversification’ and ‘asset classes’ thrown around, it’s easy to feel overwhelmed. In this Q&A, we break it down with help from Super SA's fund manager, Funds SA, so you can feel confident about how your super is working for you.

Let’s start with the basics. In 50 words or less, what does diversification in super actually mean?

In short, diversification means spreading your super across different types of investments or ‘asset classes’. It’s a strategy we use to manage investment risk. By diversifying you’re not relying on just one investment to achieve your investment objective.

Got it! So, what exactly are asset classes and how do they relate to diversification?

An asset class is simply a group of similar investment types. For example, Australian shares is an asset class. Fixed interest, property, and infrastructure are also examples of asset classes.

Investment options are made up of asset classes, which we refer to as the ‘building blocks’ for the investment options. Each option has a different allocation to each asset class depending on the investment return objective. For example, a growth option invests a higher percentage in Australian shares, while a conservative option might invest a higher percentage in fixed interest and cash.

Most investment options are made up of several asset classes so that if one isn’t performing as we expect, other asset classes are. Investing across the asset classes is the most effective way to manage risk and provide the highest probability that we can consistently deliver the option’s investment return objective over time.

If you look at the chart above, you can see how each asset class compares in terms of risk and potential return.

Generally, lower risk options like cash and government bonds offer lower returns, while riskier assets like shares and private markets have the potential for higher returns.

So why is diversification important for super?

Diversification helps protect your retirement savings from market ups and downs, and provides the best chance of achieving the return objective for your chosen investment option(s) over time.

By investing in a mix of asset classes (like shares, property, and fixed interest) your balance is less likely to be affected by poor performance in any one part of the market.

It’s about reducing the impact of market volatility and helping your balance grow more steadily over time.

Right about now, our members are probably wondering where to even start when it comes to diversifying their super.

Diversification can sound complex, but members reading this needn’t worry about doing it themselves. That’s exactly what we’re here for. Diversification is a critical part of the investment strategy we use to manage investments for Super SA members.

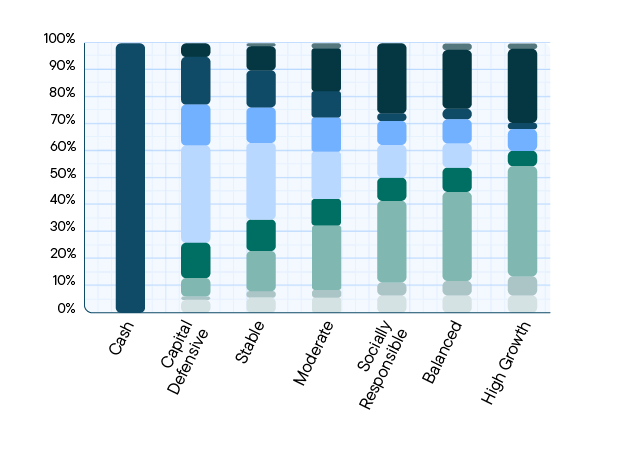

Each investment option has a different mix of asset classes depending on its investment objective. For example, the High Growth option has a higher investment return objective so includes more riskier assets, while the Capital Defensive option focuses on stability.

The chart below shows the different mix of asset classes across the seven investment options available to Triple S members.

Let’s talk about those investment options. What’s available in Triple S?

Triple S offers seven investment options to suit different goals, risk levels, and investment timeframes. These include:

-

High Growth option – higher risk, higher potential returns, a longer investment time horizon.

-

Balanced option – a mix of growth and defensive assets.

-

Moderate option – a middle ground between growth and stability.

-

Stable option – lower risk, more stable returns.

-

Capital Defensive option – focused on preserving capital with minimal exposure to growth assets, with a shorter investment time horizon.

-

Cash option – very low risk, but also low returns.

-

Socially Responsible option – invests in line with socially responsible investment criteria and targets the best companies according to external ESG ratings.

Tip: You can explore each option in more detail here: Triple S investment options

What role does Funds SA play in managing investments for Super SA members?

We’ve been the trusted investment manager for South Australian public sector superannuation funds since 1995. Our job is to invest and grow your super to help you achieve your retirement goals. We do this by applying appropriate investment strategies and carefully managing investment risk for each of the options.

Our over-arching goal is to achieve the highest possible returns while managing investment risk and liquidity.

Asset allocation (the mix of asset classes in each option) is our main tool for managing risk. While each investment option is made up of different asset classes, each asset class is made up of a portfolio of underlying investments that we carefully research, select and manage.

What’s one common misconception about super investments?

A big one is that super is just like a savings account. In reality, the investments in your super are subject to movements in markets, which means your balance can go up and down on a daily basis. But over the long term, a well-diversified investment strategy is designed to grow your savings significantly more than a regular bank account.

What advice would you give to someone who’s never looked at their investment options before?

Start by logging into your account via the member portal and checking what investment option you’re currently in. Then, think about your goals and how long you have until retirement.

You could also try the Risk Profiler Tool which is designed to help you work out what type of investor you are. If you’re unsure, reach out to Super SA or a financial planner – they can help you make informed decisions.