Market commentary

Market commentary

Section Heading

Market update and impacts on your super

Market Overview – June Quarter 2021

In 2020-21, financial markets made an outstanding recovery. The Triple S (untaxed) Balanced Default Option delivered its highest ever annual return of 21.6% for the financial year to 30 June 2021.

All Super SA’s investment options had positive returns for the June quarter, except the Cash Option, which was flat. The growth-oriented investment options delivered strong returns due to their higher allocations to share markets and unlisted markets. Given cash rates around the world are likely to be low for some time, it is expected that the Cash Option will return close to zero over the medium-term, after fees and taxes.

Triple S returns to June 2021

|

3 months |

1 year |

3 years |

5 years |

10 years |

|

|

Cash |

0.0 |

0.1 |

1.0 |

1.4 |

2.3 |

|

Capital Defensive |

2.0 |

6.6 |

4.6 |

4.7 |

5.5 |

|

Conservative |

3.0 |

11.1 |

6.1 |

6.4 |

6.9 |

|

Moderate |

4.3 |

15.3 |

7.3 |

7.7 |

7.9 |

|

Balanced |

5.8 |

21.6 |

9.4 |

9.8 |

9.3 |

|

High Growth |

6.2 |

24.5 |

10.0 |

11.2 |

10.4 |

|

Socially Responsible |

6.6 |

21.4 |

8.8 |

9.0 |

8.6 |

Returns net of fees and gross of tax, based on Super SA unit pricing formula.

*FYTD = financial year to date, that is, the return since 1 July 2020.

Section Heading

-

Global economy

The global economy continued its recovery, supported by ongoing monetary and fiscal stimulus. The global vaccine rollout has been seen as a path for countries and economies to return to a form of normal activity. As economies have opened, investor confidence has risen due to increased manufacturing activity and corporate earnings, falling levels of unemployment, and pockets of wage growth. Financial markets have largely looked through negative COVID-19 news, such as the emergence of mutant strains and sporadic lockdowns disrupting supply chains.

The focus of financial markets has begun to shift to consider reflation, and how governments globally may wind back stimulus programs and increase interest rates. At present, central banks view inflation as transitory due to the decline in consumer prices last year as well as temporary bottlenecks in global manufacturing supply chains. As the strength of the global economic recovery continued to exceed central banks’ forecasts, market participants have started to question whether interest rates will increase earlier than central banks are suggesting.

In Australia, economic data showed improving conditions as the vaccine rollout continued. The labour market and domestic activity continued to be supported by expansionary government and central bank policy.

-

Share markets

For the June quarter, international share markets performed strongly and gained 7.6% in local currency terms. The strength in share markets was driven by improving economic activity, accommodative fiscal and monetary policies, and vaccine rollouts lifting investor confidence.

The US market experienced a strong quarter, albeit with some volatility in June, after the Federal Reserve signalled interest rates may rise sooner than expected. Inflationary pressures remain a key watchpoint with the US inflation increasing 5.4% for the year to June. European share markets also performed well following positive quarterly corporate earnings reports. The vaccine rollout enabled governments across the Euro zone to loosen restrictions and economic activity was underpinned.

Emerging market equities were supported by major countries performing well. While the larger and more developed countries have experienced economic and health recoveries, many of the emerging market countries have not been so fortunate. Vaccine supply has been low and restrictive measures remain, hampering recovery. However, financial markets have looked through the slow recovery and emerging markets have delivered returns as strong as those in developed markets.

Australian Shares

Australian shares (S&P ASX 300) rose 8.5% on a total return basis over the June quarter. Sector performance was dominated by gains in Information Technology (+12.1%), Consumer Discretion (+11.6%), Materials (+9.5%) and Financials (+8.8%). The only two sectors that had negative returns were Utilities and Energy.

-

Property/Private markets

The trend towards a recovery in the Australian Property market continued in the June quarter.

The significant amount of both global and domestic capital seeking premium quality assets in core locations has seen yields in both the industrial and commercial sectors reaching all-time lows.

The retail sector, which has been the laggard over the last 12-24 months, has also shown signs of improving. The caveat remains that should the COVID-19 pandemic deteriorate in terms of lockdowns, the retail asset class will bear the brunt of the impact.

Private markets (Infrastructure and Private Equity) have experienced improved valuations as economic conditions continue to recover. Australian core infrastructure funds produced modest positive returns in an environment where investors are looking for assets with stable and predictable cash flows, such as regulated utilities.

-

Bonds/Cash

Long-term fixed income markets generated positive performance over the quarter, despite rising inflation and a pull forward of expectations around increases in interest rates. Inflation continues to concern the market as it may trigger central banks to increase cash rates earlier than expected.

The Australian market posted positive performance this quarter, with Australian government bond yields decreasing over the period.

The Reserve Bank of Australia did not change the Official Cash Rate and the Australian cash market was flat for the quarter. The yield for cash is close to zero, and it is expected that the Cash Option will continue to return close to zero over the medium-term, after fees and taxes.

-

How movements in share markets impact your superannuation option

Movements in share markets (up and down) impact the unit prices of all Super SA Investment options, with the exception of Cash. As unit prices change so does the overall value of your superannuation balance.

Although portfolios are not immune to the volatility stemming from share markets, Super SA’s asset mix, including high quality bonds, property, private equity and other unlisted assets, have helped to lessen the gyrations and deliver a smoother return profile for members.

Notwithstanding short-term fluctuations in share markets, the best long run guide to the investment outcomes of the Super SA options is their investment objectives. For example, the Triple S Balanced Investment option is targeting a return averaging 3.5 per cent above the inflation rate when measured over long-term periods (of at least 10 years).

-

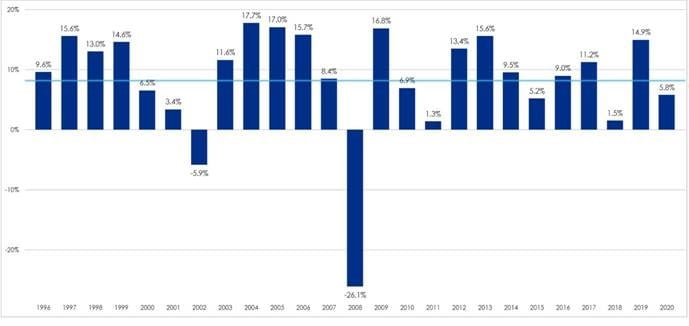

The expectation of negative returns

One of the most important concepts to consider when making an investment decision is that of risk and return. All investments, including super, have some level of risk.

Members should be aware capital losses are possible, depending on the investment option(s) chosen and their performance over time. Fluctuations in investment markets will have on-going impacts on performance. This volatility is a normal part of investing and can occur with money you may have in other super funds, the share market, and other types of investment.

Each option’s investment objective provides an indication of risk by stating the number of negative annual returns likely to be experienced over any 20-year period. For example, for the Triple S Balanced Investment option, it is expected the investment strategy will result in between four to six negative annual returns over any 20-year period. This means the risk of a negative return in any single year is between 20% and 30%.

The Chart below illustrates the annual returns of the Triple S Balanced Investment option since its inception in 2000.

Returns net of fees and gross of tax

Chart 1: Triple S Balanced option annual returns to 31 December 2020*

*Triple S Balanced Investment Option annual returns to 31 December, 2020.

Looking back over the history of the Triple S Balanced Investment Option, it has recorded a negative return for financial year periods four times, including the 2019-20 financial year. This is in line with expectations (4 to 6 years in 20).

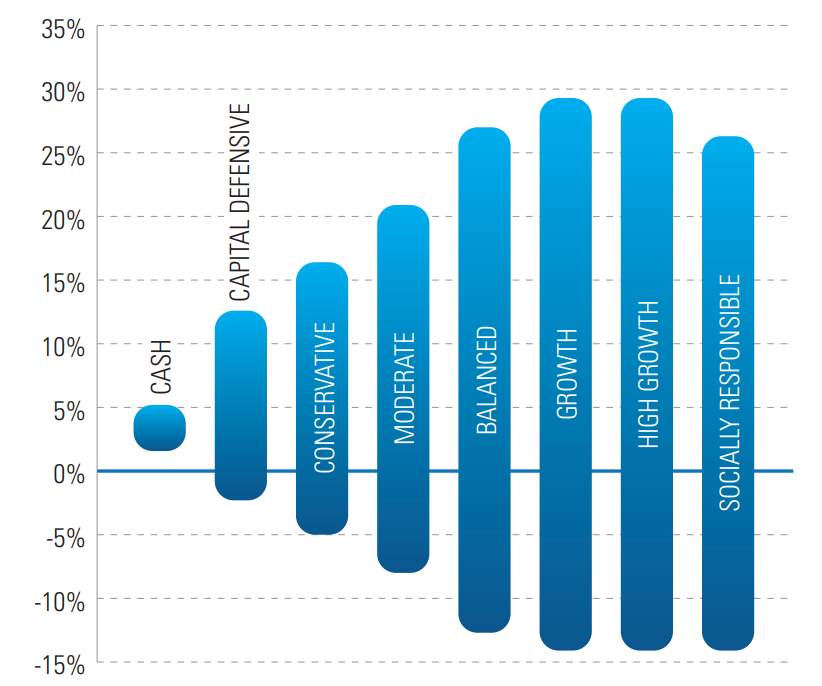

The expected range of annual return outcomes also provides an indication of risk. This varies between the options. Generally, options with the highest potential long-term returns also come with the widest range of returns including the possibility of negative returns. Options with the lowest potential long-term returns come with the narrowest range of returns and the greatest likelihood of positive returns.

Each of Super SA’s investment options has a different level of risk and return, as shown in the graph below.Chart 2 Expected range of returns over a 1-year period*

*Source - Super SA Investment Fact Sheet. Note there is approximately a 5 per cent chance the return could lie outside of this range.Understanding your attitude to risk is important and this may change over time. You may wish to periodically review your investment strategy to make sure it still meets your needs.

-

Switching your investment option is an important decisionIt’s not easy to time entry to, or exits from, markets. Selling out of more risky options (i.e. those options with larger allocations to assets such as shares and property) and switching into less risky options (such as cash and options with higher allocations to fixed interest) can be costly over the longer term as it effectively locks in the losses which result from poor investment markets. As well, it is possible to miss out on future growth by being out of the market when it recovers.

We understand you may be concerned about the impact of market movement on your super. We encourage you to think about your super as a long-term investment generating a return over multiple years. We suggest you don’t focus narrowly on short-term results.

Many members seek professional financial advice, especially those members approaching or in retirement.

There are a number of investment options offered by Super SA to suit members with differing risk appetites and time horizons.

Section Heading

| Funds SA Disclaimer The information in the article above has been prepared in good faith by Funds SA. However, Funds SA does not warrant the accuracy of the information and to the extent permitted by law, disclaims responsibility for any loss or damage of any nature whatsoever which may be suffered by any person directly or indirectly through relying upon it whether that loss or damage is caused by any fault or negligence of Funds SA or otherwise. The information is not intended to constitute advice and persons should seek professional advice before relying on the information. |